The Upcoming Real Estate Crash!

Demand

A recent report from realtor.com shows home buyer demand remaining strong. You’d think buyers would feel discouraged after two years of writing rejected offers. But in reality, many aspiring homeowners saved money (YOLO'd into Bitcoin) throughout the pandemic, and are determined to persevere in this Sellers Market.

*More than 9 in 10 homebuyers plan to offer more than 20% down, and check online listings daily for market trends.*

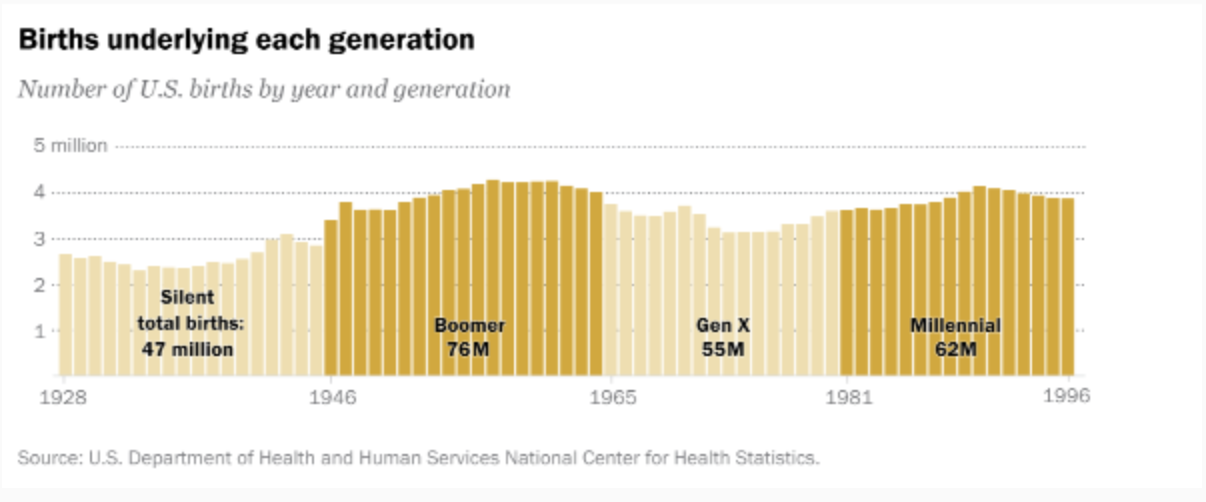

To add fuel to the demand market, more and more Millennials age into prime home-buying age each day! In fact, Millennials accounted for more than half of all new home loans in the first months of 2020, and consistently stayed there for the first part of year. Many economists forecast the Millennial hunger for housing will stimulate buyer demand for years to come. Turns out Millennials, famously known for their student loan debt, are eager to take on some mortgage debt.

Lumber And The Supply Crisis

Lumber began to skyrocket in April of 2020 when COVID-19 first took hold. Production was ill prepared for the high demand that followed. Who could've predicted people would pick home improvement as a pandemic hobby?

Lumber prices have now almost tripled in the last four months do to the ongoing supply chain issues and a strong wildfire season across the western United States. This latest surge of lumber costs adds more than $18,600 to the price of a new home. That doesn't include the cost of labor by the way...

So consider how this affects Replacement Cost--the cost of labor, materials, time, etc. it would take to rebuild your home from scratch. This all plays a role in determining the value of real estate.

Interest Rates

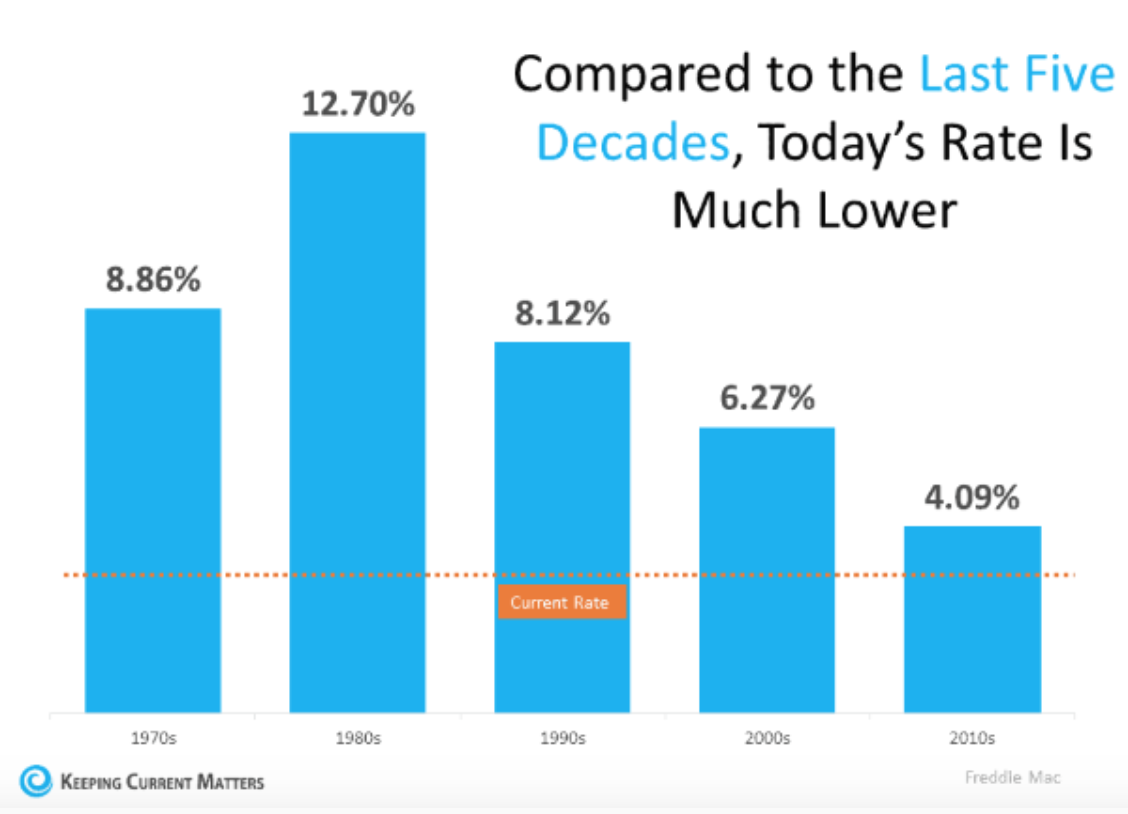

Part of what contributes to the recent high demand is record low mortgage interest rates. In 2022, we're expecting to see some rate hikes. What does this mean? It only takes a few minutes of playing around with a mortgage calculator to realize your monthly payment on a loan goes up when interest rates go up.

When rates fell below 3% in 2020, home buyers were eager to lock in a consistent low monthly payment on homes they normally wouldn't be able to afford.

Even though interest rates are expected to rise as the FED tapers Mortgage Back Security purchases, experts believe home buyers are still going looking to seize the opportunity. Although rates will be high in comparison to the recent record lows, they’ll still be low historically.

It's ok to be upset about missing the below 3% interest rate. The FOMO is real! But perspective is key.

Closing Thoughts

What does all this mean? What's going to happen in 2022? According to experts, the housing market is NOT projected to decline. But the rate of appreciation is expected to slow down sharply from the unprecedented 18-20% year over year increase over the past two years. They're predicted to rise, but at a more stable pace.

All that being said, home prices fluctuate. They go up, and they come down. Much like the stock market. So back to the original question. Is now the right time to buy?

The answer you’ll probably get from most agents is “yes it is!”. The real answer is: your situation is unique, and there needs to be more nuance when it comes to making an important decision like this. You want an agent who not only follows the trajectory of the market, but also, and most importantly, considers your financial and personal goals.

So before you think about whether or not it's a good time to buy a home, ask yourself this very important question:

Why do you want to buy a home?