Real Estate Bubble Pop 2022

Spring Has Sprung!

Spring is in the air. Look around, take a good whiff! Cheers to new beginnings, new opportunities, and new life. Wishing all of you a bright, warm, and prosperous Spring! Now... let's talk real estate.

What is inflation?

Inflation is the decline in purchasing power over time. To put it simply, it means your dollar, unfortunately, isn't as valuable as it was yesterday. Inflation is usually expressed as the annual change in prices for a basket of goods. Can anyone guess what year this newspaper ad is from?

The Fed

The Federal Reserve (The Fed) is the institution that's responsible for managing inflation. The Fed's primary measure for inflation is the Personal Consumption Expenditures Index (PCE), and its target is to maintain a 2% average annual increase. Well, PCE data climbed to 6.4% in February from the previous year--that's the fastest jump we've seen in the last 40 years!

Much like the party guests who won't leave after the party ended, inflation is hanging around longer than expected! And after a long night of entertaining, the Fed is a very tired host.

How Did We Get Here?

In early 2020, COVID-19 stunned our economy. Lockdowns sent unemployment to an all-time high and restrictions hindered the economy's ability to produce goods and services.

In an effort to help stimulate the lagging economy, the Fed aggressively purchased mortgage-backed securities and lowered interest rates. As a result, huge deposits of cash were flooded into the economy! Does anyone else have a tendency to overwater their plants in the Spring?

In order to combat the rising inflation resulting from the increased money supply, the Fed now has to raise interest rates. Higher rates mean higher borrowing costs. Higher borrowing costs mean lower demand!

How Higher Rates Affect Demand

Higher interest rates affect your purchase power and your monthly payment. For example, if we compare today's rate (5.06%) to 2020's low rate (2.7%) on an $800k property with 20% down, the difference in your estimated monthly payment is $863.

If that doesn't seem like a whole lot to you, think about it this way... That's a difference of $10,356 a year, and $310,680 over the life of the loan!

This recent rate adjustment has either led buyers to adjust their expectations or has priced them out of the market. So here comes the big question: will this be enough to cool the red-hot seller's market?

The Bubble

When is the Real Estate bubble going to pop? By far, this is the most common question I get as a real estate professional.

There are a few reasons why I think we aren't in a bubble. Things are a little different than they were in 2007, (for example higher lending standards). But the biggest reason, in my opinion, is that we have a major housing shortage!

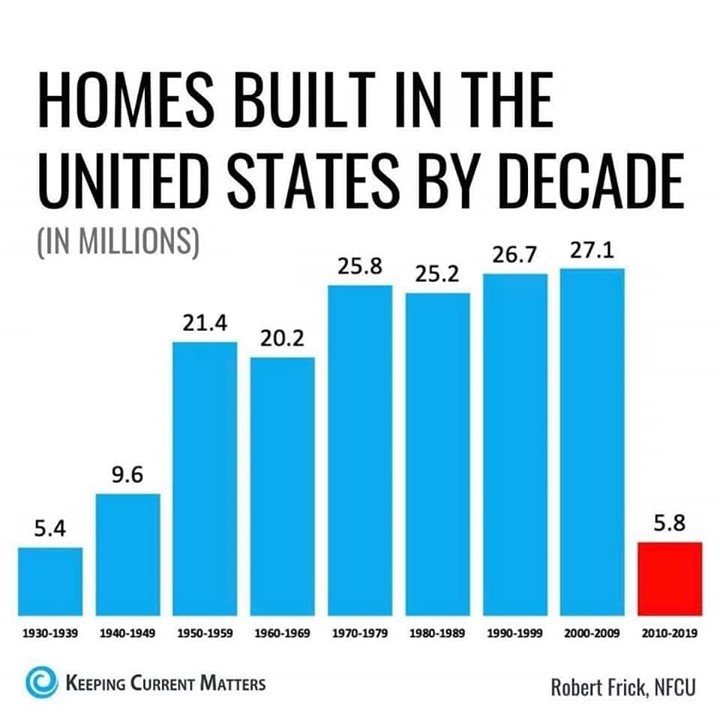

Take a look at the graph below. Compared to previous years, hardly any homes were built after the 2007-2010 crash! And you have to consider the fact that Millennials, who now make up the majority of the population, are entering peak home-buying age faster than you can say, "Ok, Boomer!"

It's almost impossible to have a crash when there is a shortage of something!

What Does This Mean For You?

So here's what we know: inflation is high, interest rates are climbing, and housing affordability is taking a hit. But what does this mean for you?

Here's the truth. The answer is different for everyone!

Your financial and personal goals, at a glance, might align with those of your friends, neighbors, and family members. But more often than not, there are unique distinctions. Give me a call, shoot me a text, or send me an email so we can have a conversation about it. Because I'm here to help you!

So before we go, let's answer that question with a more important question... what are your motivations for buying, selling, or renting?